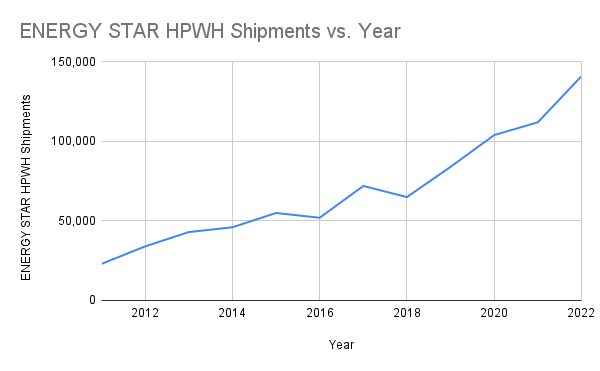

Energy-efficient water heating took significant strides in 2022, according to the latest data released by ENERGY STAR. Sales of heat pump water heaters (HPWHs) grew 26% last year while sales of gas water heaters declined by 17%, underlining a clear shift in the U.S. toward more efficient, electric powered water heating systems.

This is good news for the HPWH industry, which has seen significant growth in its first decade on the market, but still accounts for less than 2% of the water heater market. It’s also good news for the environment, as HPWHs have energy efficiency levels 2-4 times higher than other types of water heaters, and save one ton of CO2 annually on average compared to gas water heaters. The average gas tank water heater is responsible for 64% more greenhouse gas emissions than a comparable HPWH (factoring in refrigerant and upstream methane impacts).

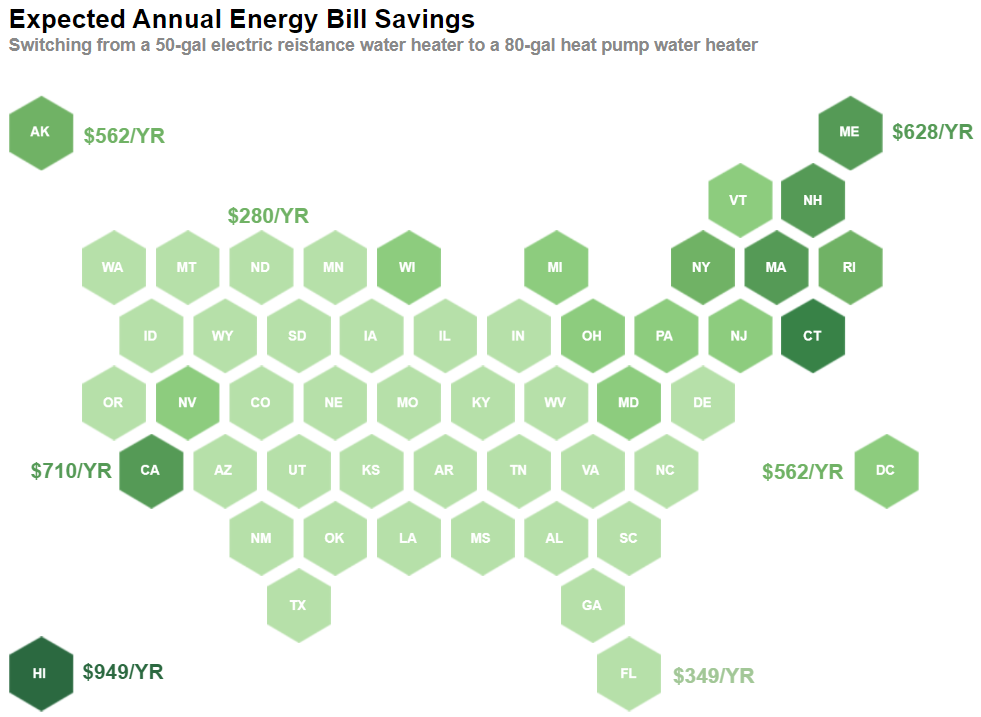

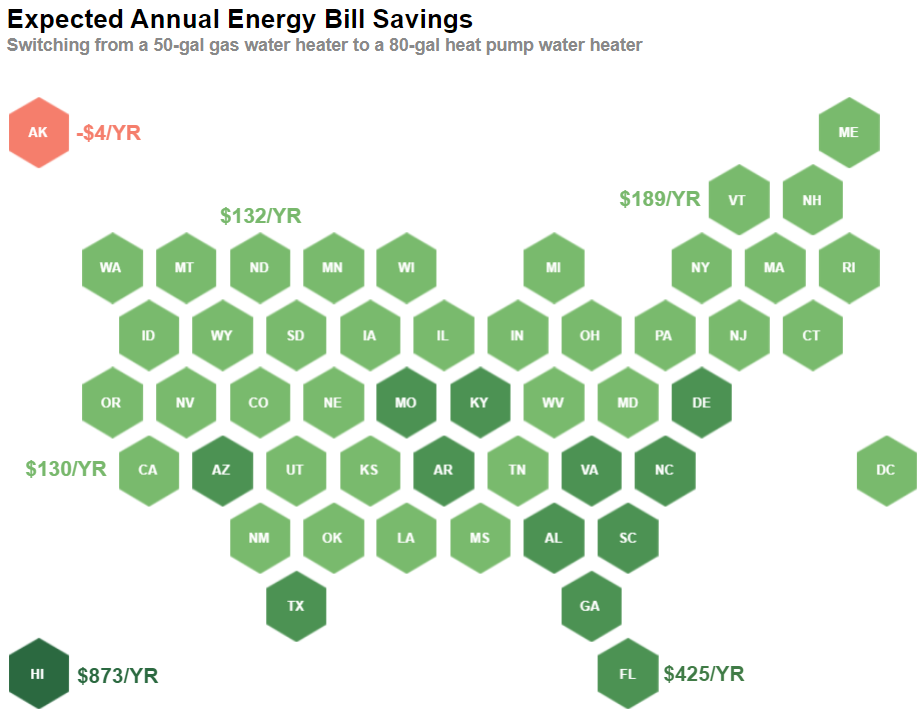

It makes financial sense to heat water with a heat pump. On average, a HPWH will save $550/year for a family of four over an electric resistance water heater, and $200/year over a gas water heater (a HPWH on average costs $117/year to operate while a gas water heater costs on average $325/year to operate), according to ENERGY STAR and Energy Guide. And, starting in 2023, American households became eligible for a 30% tax credit up to $2,000 when purchasing and installing an ENERGY STAR-certified HPWH, making this energy-saving technology even more appealing.

Expected annual savings when switching to HPWHs from electric resistance and gas using state level utility data from EIA and energy usage estimates from Energy Guide. Graphics created by Noah Gabriel, Senior Project Analyst, New Buildings Institute.

What drove the uptick in HPWH sales last year? Industry insiders point to California, which offers significant incentives for HPWHs in line with its goal to phase out fossil fuel-fired equipment like gas water heaters by 2030, in an effort to improve public health and reduce GHG emissions. While California is a leader, the Pacific Northwest and Maine are also seeing significant adoption of HPWHs.

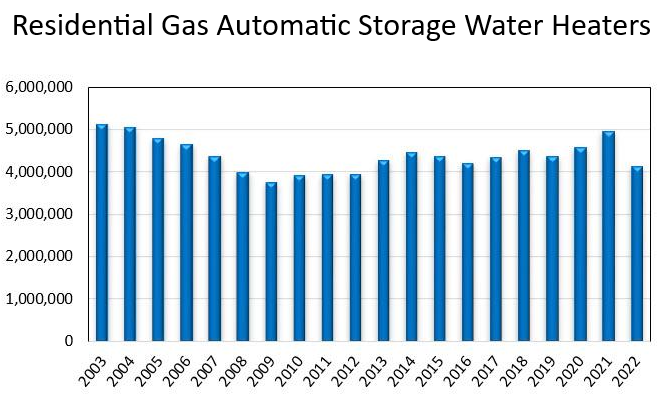

Despite gas-fired water heaters accounting for approximately half of all water heater sales over the past 20 years, sales of all types of gas-fired water heaters fell in 2022. The overall gas water heater market declined 17% from 2021 to 2022, hitting its lowest level since the Great Recession (2007-2009).

This decline included ENERGY STAR-certified gas water heater models such as tankless water heaters, which fell by 6%, and condensing units, which fell by 22%. 2022 marks the first time that one-year sales of both models have declined since 2011. So far in 2023, sales of gas water heaters have stayed consistent with 2022 numbers. Is this the beginning of a long-term trend away from heating water with fossil fuels?

ENERGY STAR has indicated it will begin to phase out certification of gas water heaters in the near future, writing in its latest product specification for water heaters, “Based on current analyses, it will make sense to sunset the gas water heating criteria in the near future.”

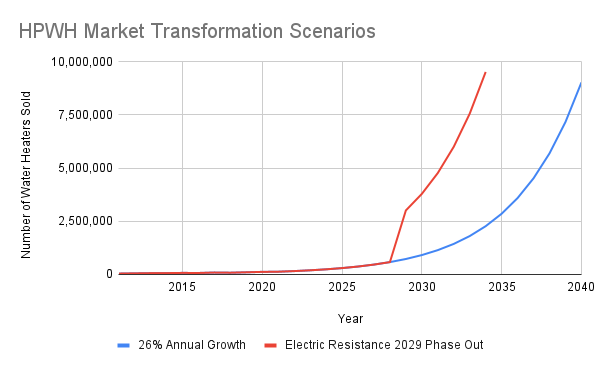

Market indicators signal increased growth for HPWHs

Due to the climate and air pollution implications of gas-fired hot water heaters, various levels of government—from air quality districts to state governments to cities—are phasing them out. Furthermore, the U.S. Department of Energy, which sets minimum standards for all appliances, recently proposed phasing out electric resistance water heaters larger than 35 gallons by 2029. DOE estimates its proposed water heating standards would save consumers $11.4 billion on their energy and water bills every year, bringing enormous financial benefits to U.S. households. With more than 4 million electric resistance water heaters sold annually, the rule making could lead to a dramatic increase in HPWH sales by the end of the decade.

The chart below shows two potential scenarios for the growth of HPWH sales. The blue line indicates HPWH sales growing at 2022’s 26% growth rate through 2040. The red line shows the potential impact of DOE’s proposed phase-out of electric resistance water heaters larger than 35 gallons, resulting in the realistic possibility of a 50% market share for HPWHs by 2029.

We are at an important crossroads in the water heating industry. Public policies, state and federal incentives, and consumer demand could lead to a drastic increase in HPWH sales in the coming years. While 2022 was a big year for the HPWH industry, many signs point to continued and possibly exponential growth in the years ahead. Stay up to date on news and trends in water heating by signing up for the Advanced Water Heating Initiative (AWHI) newsletter. Join us for HPWH Day on Wednesday, October 25, 2023. The day will be dedicated to HPWH education and awareness with special online events and resources from AWHI partners.

by Joe Wachunas, Project Manager

Bio

Did you enjoy this content? Consider supporting NBI’s work with a donation today.